Collateral Vaults

Collateral vaults are custom singletons that can be created permissionlessly by anyone.

Users can deposit XCH into a collateral vault to borrow BYC against it.

Inner puzzle

Collateral vaults are bound to an inner puzzle, via the curried arg INNER_PUZZLE_HASH, which ensures that only the legitimate owner can perform certain operations, the owner operations, on it.

The inner puzzle must satisfy certain minimum requirements in order to prevent funds from getting permanently locked in a collateral vault.

Stability Fees

Loans taken out from collateral vaults accrue interest, also known as Stability Fees (SFs). The debt owed to a vault increases every minute according to the Stability Fee Discount Factor (SFDF) from Statutes. The corresponding annualized Stability Fee percentage rate (APR), which is the figure typically shown to the user in frontends, is calculated as

For example, if SFDF is set to 1.00000018133597, then the APR is 10%.

If a loan is taken out, then the corresponding debt is simply the principal of that loan multiplied by all SFDFs from the time the loan was taken out, , until the current time, :

The SFDF can change over time. Storing individual historical SFDFs in the protocol would be prohibitive from a cost perspective. Instead, the protocol keeps track of the Cumulative Stability Fee Discount Factor (CSFDF), which is the product of all SFDFs from protocol launch until the timestamp of the current Statutes Price, :

This parameter is stored in Statutes and automatically updated by the protocol whenever the Statutes Price is updated. This ensures that the CSFDF is always reasonably up-to-date.

The Current Cumulative Stability Fee Discount Factor (CCSFDF), which is the discount factor up to the current time, , and the discount factor most commonly used in protocol-internal calculations, is given by

A change to SFDF does not automatically cause an update of the Statutes Price and hence the CSFDF. This means that in the calculation of CCSFDF, the new SFDF may be used retroactively from onwards.

Keepers may be able to trigger an update of the Statutes Price in the same block or shortly after a change to SFDF, but this depends on the timestamps of the Oracle prices stored in the Oracle. If new Oracle prices were always added at the earliest opportunity, i.e. no later than indicated by Oracle Price Delay (STATUTE_ORACLE_PRICE_EXPIRATION_SECONDS), then in the calculation of CCSFDF, the retroactive period over which the new SFDF is used will not be longer than twice the Oracle Price Delay.

Users should keep in mind that although any change in the CCSFDF caused by a retroactive application of the SFDF is generally fairly small due to the limited period over which any retroactivity applies, it can in theory unexpectedly push the debt of a vault past the Liquidation Threshold. Users with vaults close to liquidation should therefore monitor the protocol for governance proposals to modify the SFDF.

Note that the vault owner passes in the current time as an argument when performing a borrow or repay operation, and is given a three minute window of flexibility vs the actual block timestamp to reduce the likelihood that an operation times out and will fail to be incluced in the blockchain. Since a malicious vault owner could exploit this flexibility by borrowing in the future and repaying in the past, the actual definition of CCSFDF in the collateral vault puzzle includes an additional factor SFDF^3 when used in repay operations.

Loan and debt accounting

Each vault keeps track of the principal (P) of outstanding loans, and the discounted principal (DP). Principal and discounted principal get updated whenever BYC is borrowed from or repaid to the vault. Principal also gets updated when a Stability Fee transfer is performed.

The principal is the net amount of BYC borrowed and repaid:

where are the principal amounts of the loans taken out, and the principal amounts of the loans repaid.

The discounted principal is effectively the vault's principal valued at vault creation, and simply the sum of all principal amounts borrowed and repaid discounted by the respective CCSFDF at the time:

where are the times when loans were taken out, and the times when loans were being repaid.

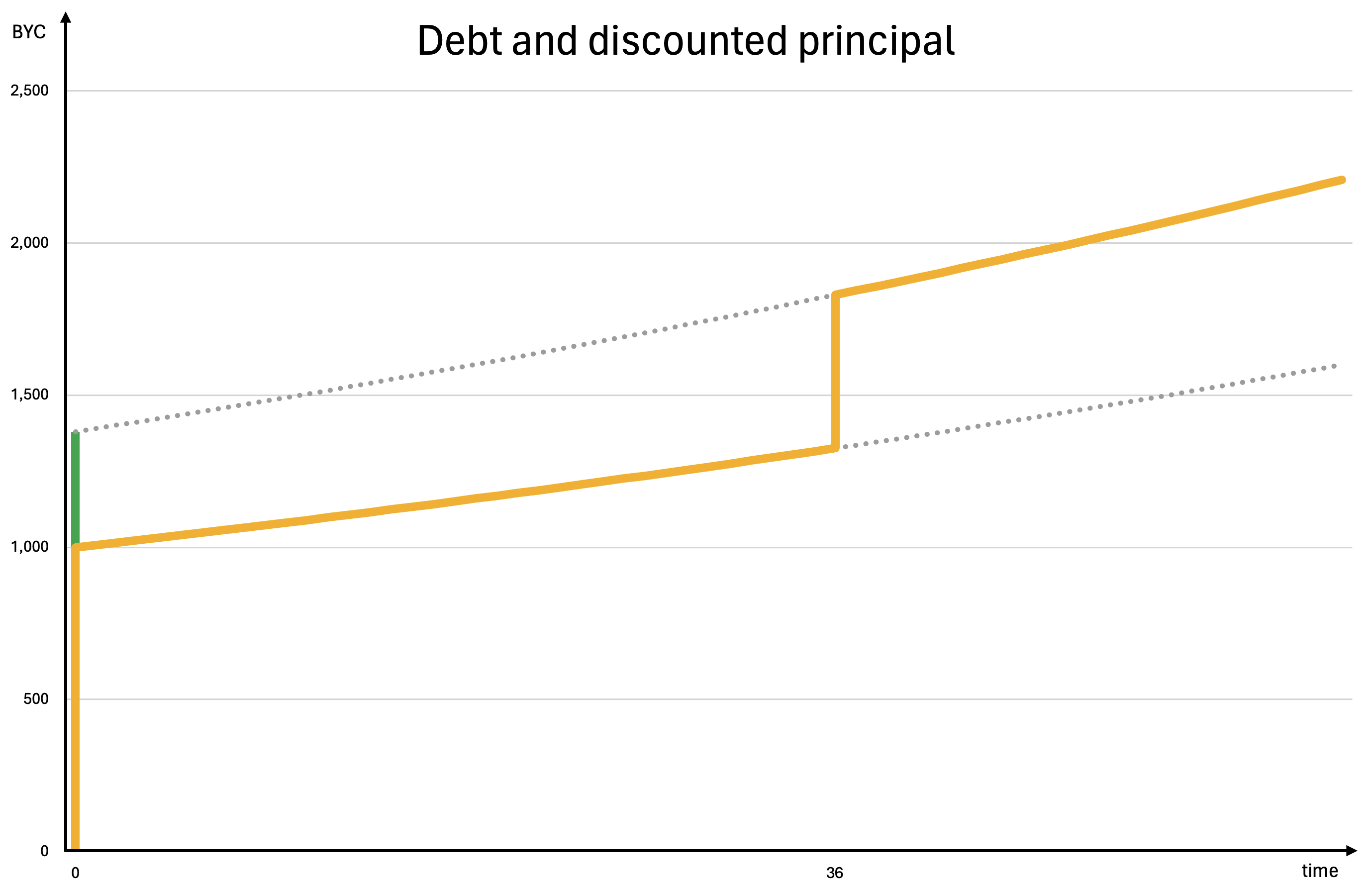

For example, assume that the Stability Fee is 10% annualized, a vault is created, and a 1000 BYC loan taken out immediately. This is the first vertical orange line in the chart below. At this point, principal, debt, and discounted principal are all equal to 1000 BYC. As time passes, Stability Fees accrue and the debt slowly increases along the orange line. Now assume that a second loan, for 500 BYC, is taken out 36 months later. This is the second vertical orange line in the chart. Both the vault's principal and debt increase by 500 BYC. The principal is now 1500 BYC, and the debt 1000 * 1.1^3 + 500 = 1831 BYC. The discounted principal on the other hand only increases by 500 / 1.1^3 = 376 BYC, as shown by the green vertical line.

A vault does not keep track of its debt in a separate variable. Instead, it is calculated ad hoc by undiscounting the vault's discounted principal using the CCSFDF:

Finally, it is possible to calculate accrued Stability Fees of a vault at any given time as

Note that due to the coinset model, the protocol itself does not know the total principal, discounted principal or debt across all vaults. If a corresponding state variable was introduced in Statutes, it would be impossible for different vaults performing operations in the same block. Fast-forward or singleton spend aggregation could theoretically help, but since the Statues spend is rather big, this would be very costly, and ultimately not scale.

Stability Fee transfers

It is possible to issue BYC against accrued Stability Fees. Any BYC issued in this way is transferred directly to the Treasury.

SF transfers ensure that as much BYC can be brought into circulation as there is debt. This is key to preventing a structural BYC shortage, which could result in BYC trading above its 1:1 peg to the US Dollar.

SF transfers are the preferred mechanism to top up the Treasury, as it is quicker than holding a recharge auction and doesn't dilute CRT holders. Keepers should transfer fees on an ongoing basis to keep the Treasury filled to near the Treasury Maximum. This ensures that savers can withdraw interest on demand without first having to transfer SFs themselves.

When setting the Treasury Maximum, governance should take into account that keepers can transfer accrued SFs to the Treasury at any time. If the Treasury Maximum is set too low, Surplus Auctions could be triggered, draining the Treasury of BYC needed to cover liabilities towards savers.

Operations

There are five collateral vault operations that can only be performed by the vault owner, and one keeper operation not related to liquidation.

Puzzle that operations are performed on: collateral_vault.clsp

Owner operations:

- deposit: deposit collateral - puzzle: vault_deposit.clsp

- withdraw: withdraw collateral - puzzle: vault_withdraw.clsp

- borrow: take out a loan - puzzle: vault_borrow.clsp

- repay: repay debt - puzzle: vault_repay.clsp

- transfer: transfer ownership of collateral vault - puzzle: vault_transfer.clsp

Keeper operations:

- transfer Stability Fees: issue & transfer BYC to Treasury - puzzle: vault_keeper_transfer_sf_to_treasury.clsp

- See the Liquidation page for keeper operations relating to vault liquidation:

- start auction: start a liquidation auction

- bid: submit a bid in liquidation auction

- See the Bad Debt page for keeper operations relating to Bad Debt recovery:

- recover bad debt: extinguish bad debt

Owner operations and Stability Fee transfers can only be performed if post-operation the vault is sufficiently overcollateralized. This protects against griefing attacks in which a vault owner attempts to delay or prevent liquidation by repeatedly spending a liquidatable vault.

Deposit

Deposits XCH into the collateral vault. All deposited XCH is automatically used as collateral to secure the vault's debt.

The operation can only succeed if after the deposit the vault is sufficiently overcollateralised. The only situation in which this may not be the case is if the vault is liquidatable but liquidation has not been started yet.

State changes

COLLATERAL: increases by the amount deposited

Withdraw

Withdraws XCH from the collateral vault.

The operation only succeeds if after the withdrawal the vault remains sufficiently overcollateralised based on a liquidation ratio of LR + 1.

State changes

COLLATERAL: decreases by the amount withdrawn

Borrow

Borrows Bytecash from the vault.

Borrowed Bytecash is minted by the Protocol. Borrowing increases the debt owed to the vault as explained above.

The operation only succeeds if after taking out the loan the vault remains sufficiently overcollateralised based on a liquidation ratio of LR + 1.

State changes

PRINCIPAL: increases by the amount of BYC borrowedDISCOUNTED_PRINCIPAL: increases by the amount of BYC borrowed discounted back to Statutes launch

Repay

Repays debt owed to the vault.

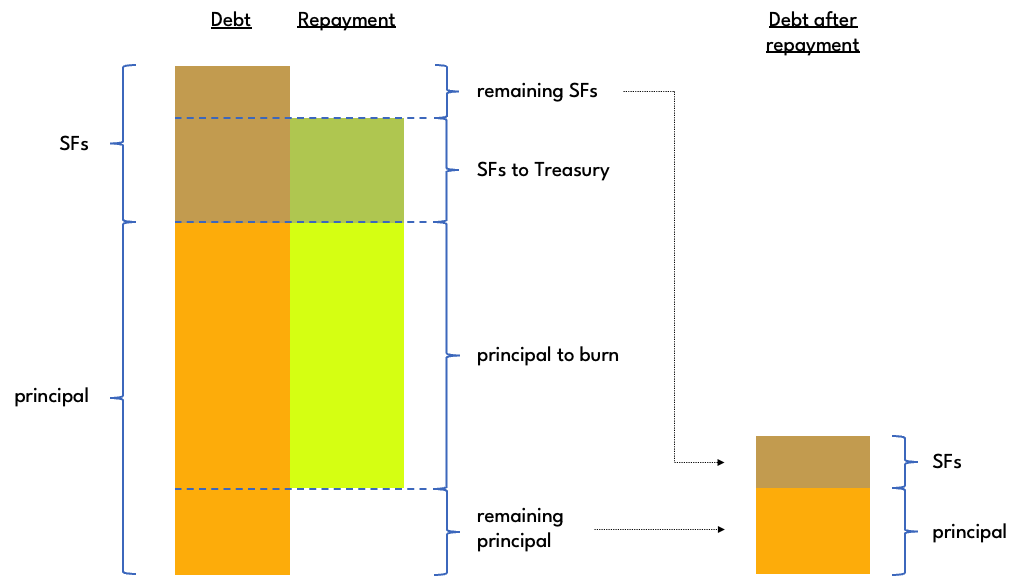

The protocol allows for the repayment amount to be split in any way possible between principal and accrued Stability Fees. For any Stability Fees being repaid, an identical amount of BYC is issued and paid into the Treasury. The diagram below shows an example where some principal and some accrued SFs are repaid.

The app doesn't let borrowers decide how the repayment amount is split. If the repayment amount is not larger than the principal, then the entire amount is used to reduce the principal. Otherwise, accrued SFs are reduced as much as possible and the remaining repayment amount, if any, is applied against the principal.

The amount of SFs being repaid, if not zero, must exceed the Minimum Treasury Delta. This prevents coin hogging attacks on both Treasury and collateral vault coins.

The operation only succeeds if after the repayment the vault is sufficiently overcollateralised. The only situation in which this may not be the case is if the vault is liquidatable but liquidation has not been started yet.

State changes

PRINCIPAL: decreases based on amount repaid according to methodology described aboveDISCOUNTED_PRINCIPAL: decreases based on amount repaid according to methodology described above

Transfer

The ownership or custody arragements of a collateral vault can be changed using the transfer operation, which replaces the vault's inner puzzle hash.

The operation can only be performed if the vault is sufficiently overcollateralised.

State changes

INNER_PUZZLE_HASH

Transfer Stability Fees

Issues BYC against a collateral vault's accrued Stability Fees. BYC issued is atomically transferred to Treasury. A SF transfer leaves the vault's debt unchanged.

The amount of BYC issued when transferring Stability Fees is always the maximum possible amount. This amount is calculcated by calculating the cumulative SF discount factor used to undiscount DISCOUNTED_PRINCIPAL using current_timestamp rather than current_timestamp + 3 * MAX_TX_BLOCK_TIME. This prevents a situation where timestamp flexibility results in more BYC being issued than debt owed to the vault.

A SF transfer is only permitted is the transfer amount exceeds the Minimum Treasury Delta. This prevents coin hogging attacks on both Treasury and collateral vault coins.

The operation can only be performed if the vault is sufficiently overcollateralised.

State changes

PRINCIPAL: increases by the amount of SFs transferred

State and lineage

Fixed state:

OPERATIONS: a two-element struct containing owner operations and keeper operation hashesOWNER_OPERATIONS: a list containing deposit, withdraw, borrow, repay and transfer operation hashesKEEPER_OPERATIONS: a list containing transfer Stability Fees, and liquidation-related operation hashes

MOD_HASH

Immutable state:

STATUTES_STRUCT

Mutable state:

COLLATERAL: amount of collateral in vault (in mojos)PRINCIPAL: principal amount of outstanding loans (in mBYC)AUCTION_STATE: state of liquidation auction (if any)INNER_PUZZLE_HASH: inner puzzle hash of vaultDISCOUNTED_PRINCIPAL: discounted principal amount of oustanding loans (in mBYC)

Eve state

The vault puzzle enforces an eve state in which all mutable state variables except INNER_PUZZLE_HASH are 0.

Note that a non-eve collateral vault can be in eve state. This can happen either by the vault owner withdrawing all collateral from a debt-free vault, or by all bad debt being extinguished by a keeper following a failed liquidation.

A collateral vault can leave eve state only by having the deposit operation performed on it.

Amount

The amount of an eve vault is enforced to be 0. The amount of a non-eve vault depends on the amount of collateral held in it, which is always equal to the COLLATERAL state variable.

Lineage

Collateral vaults are singletons and as such enforce lineage. The eve lineage proof is nil. Non-eve lineage proofs are

lineage_proof = (parent_parent_coin_ID parent_curried_args_hash parent_amount)

where parent_curried_args_hash is the hash generated by curried_values_tree_hash function applied to the list of treehashes of non-fixed state variables of the parent vault coin. From this the puzzle hash of the parent vault coin can be obtained as follows:

parent_puzzle_hash = (tree_hash_of_apply MOD_HASH parent_curried_args_hash)

where tree_hash_of_apply is the standard function used to obtain the puzzle hash when mod hash and state hash are given.